The concept of “programmable money” made possible by the blockchain has gained a substantial amount of traction this year, but this is just the beginning.

With about $13B assets in decentralized finance, the space is evolving at an extremely rapid pace. However, it is still in a nascent phase with the potential of bringing new paradigms to financial services. To create a mapping from mainstream financial services to defi, we will use the fintech space as a proxy.

Fintech has unbundled banks and almost every other traditional financial institution. Moreover, those institutions otherwise known as “traditional” are also going out of their ways to embrace high tech by building it into their products or making strategic acquisitions.

But before we go further with defi, here are a few relevant insights on today’s fintech industry:

- An important aspect that characterizes some parts of fintech — but doesn’t apply to defi — is the partnership between fintechs and small, community-oriented banks. For example, Sutton bank, Cross River Bank, Emigrant Bank, East West Bank are providing white-label services to fintechs by acting as the bottom layer of their banking infrastructure.

- The most widely adopted fintech applications include payments and money transfer. Wallets and mobile payments, cards by challenger banks, and online banking are among the most impactful fintech services. We are also seeing an increase in lending. The regions most proactive in fintech adoption are Asia and Europe.

It has proven quite challenging to draw a direct mapping from fintech to defi, which goes to show that defi has “re-defi-ned” a lot of things. Most notably, it birthed a range of asset classes that don’t exist in traditional capital markets. At the same time, there are many mainstream financial service use cases that are not yet reflected in defi. Some gaps, such as accounting and corporate banking, may still make sense. Others do represent opportunities . As you will see, the space has been pretty occupied with money markets and arbitrage opportunities.

The detailed “map” can be viewed in spreadsheet form.

The question we should ask is, “in which categories could defi present a better solution than mainstream?”

I will start with a summary of my key takeaways from this exercise, followed by a more detailed comparison between fintech and defi for each financial service category: Wealth management, capital markets, banking, real estate, lending, insurance, payments, accounting, data aggregation, compliance, and financial infrastructure APIs.

Takeaways on Defi

Insight #1: Activity is highly skewed towards “capital markets”

Defi is re-architecting the stock market. Over the past year, most of the hype came from events such as the COMP (Compound) token explosion and Uniswap’s daily trading volume exceeding Coinbase’s.

Defi is characterized by brand new asset classes and protocols that enable automated market making, liquidity, and loans. As such, the individuals and parties involved in defi are mostly crypto-savvy or at least technical (in the engineering or financial sense), as well as institutional investors (whales).

It is extremely easy to get started on any decentralized exchange or lending protocol. While we think of traditional markets exchanges and brokers, defi has a few components that can be accessed independently or through aggregators:

- Liquidity pools / Automated Market Makers: Uniswap, Curve, Balancer

- Lending protocols: Compound, Aave

- Aggregators: Yearn.finance, 1inch

- Exchanges: Matcha, dydx

There are still a number of inefficiencies and loopholes in this space: Whales can significantly influence the yield on markets, the platforms are hacked all the time (and subject to smart contract bugs), and huge gas fees which can make it expensive to even get started.

If we were to put defi activity on the map of all financial services, there would be an enormous cluster in capital markets.

Looking at the defi categories on the DeFi Pulse leaderboard, most of them are associated with capital markets — with the exception of Payments. Even lending is arguably within the realm of markets, rather than traditional loans.

For comparison, this is what the more established fintech landscape looks like:

There is also a large concentration of total value locked in assets, “lending”, and DEXes. These categories represent least 85% of that total $13B in value locked.

Let’s go over a few of the gaps that may represent interesting opportunities within defi. Again, it’s not just about the untapped categories — but whether defi is uniquely or better equipped than mainstream finance to tackle these blank spaces.

- Payments & Money Transfer: Traditionally, this is an almost $3T industry — and highly saturated in fintech. Within defi, standout projects include Flexa, Connext, and Sablier. Flexa is already helping merchants accept stablecoins through a private beta. Connext is enabling micropayments. Sablier is introducing the option of “streaming” your pay. All of these are innovative solutions, but that’s still not where the majority of defi is focused on. An opportunity could exist between payments, wallets, and capital markets. Defi is uniquely equipped to allow the assets parked in your mobile wallet to make money while you sleep. We do have Argent and Dharma as “frontend” apps with beautiful UX, but we have yet to see more “wallet” products focused on sending & receiving. Defi brings promising improvements compared to mainstream payments, which have much more complex rails (see my reading notes from Payments Systems in the US).

- Wealth management: Fintech apps like Personal Capital, Wealthfront and Betterment have garnered enormous success with tools that can automate and manage your budgeting and investing. Within defi, we have portfolio management tools such as Zerion and Instadapp, which also open you up to various investment vehicles and track your portfolio’s performance. What might be missing is a robo-advisor feature. A lot of defi investors are still using spreadsheets to track their returns — which is fair, but not everybody wants to follow their investments obsessively. Some people would rather take the dollar-cost averaging or long-term/passive approach.

- Consumer lending (not just for assets): When we think of lending in defi, perhaps the most compelling concept that comes to mind is flash loans. What is still missing is the feasibility (and a user’s willingness) to take out a loan for a longer period of time, for purposes other than trading.

- Real estate investing: We have seen some projects that leverage the blockchain to tokenize real estate and farmland. Defi has made it extremely easy to create synthetic assets. We will need to build up the systems and products to convert real assets into their synthetic versions, and track their ownership as well as value over time. We will go deeper into this in insight #2.

Insight #2: New digital assets

Defi has been all about inventing unforeseen asset classes that don’t yet exist (or wouldn’t be possible) in traditional finance. Even beyond asset classes, it has enabled alternative ways to invest, such as prediction markets like Polymarket and Upshot, a Q&A protocol.

There are more assets to be created and discovered, whether it’s in real estate, collectibles (NFTs), future beliefs, or something completely new.

One can use Synthetix creatively, and list tokens on marketes like Balancer or Uniswap.

Insight #3: The new financial stack

In his article “Fintech Infrastructure 101”, investor Chris McCann illustrated the financial stack behind fintech. This is how the fintech and defi stacks might look next to each other:

I did not allocate a specific layer for “developer” since the developer can be present at any layer — including the asset level — which is not the case for bank deposits (fiat money).

The defi stack is leaner and more “customizable”, but also more volatile.

Insight #4: Impact of CBDC on acceptance of stablecoins

China has been steadfast about its digital Yuan, which may spawn unprecedented curiosity and acceptance of digital currencies. Even though this may not be specific to defi, it is likely that the “masses” will come to embrace an alternative representation of money. This can facilitate the adoption of assets such as DAI, USDC and their derivatives.

Detailed comparisons by fintech category

In order of market size

Wealth Management ($75T)

Wealth management in defi is mostly about portfolio tracking, rather than helping you manage your income, plan your budget, and choosing how to invest.

Fintech

- Robo advisors: Wealthfront, betterment, Ellevest

- Retail investing & portfolio management: Robinhood, Personal Capital

- Personal finance: Digit, Albert, ClarityMoney

Defi

- Portfolio management + investing: InstaDApp, Zerion, Ray, Idle Finance, Snowball Money, Set Protocol, Argent, Dharma

Capital Markets ($74T)

In my opinion, this was the most fascinating comparison. Market makers in traditional finance tend to be high-frequency trading firms. For example, Citadel is the largest Designated Market Maker on the NYSE.

In defi, it is harder to distinguish between exchanges and market makers. This is an example of defi’s “money lego” and interoperable nature: Uniswap can be seen as both a market maker and an exchange. You can choose to contribute to a liquidity pool, earn UNI tokens and then go to another exchange like Matcha to trade.

We will split the capital markets category into Exchanges and Asset classes.

Fintech Exchanges

- Exchanges: IEX, Mercatus, Trumid, Openfin, LTSE

- Market Makers: Citadel Securities, Virtu Financial

Defi Exchanges

- Exchanges: 0x, 1inch, dydx

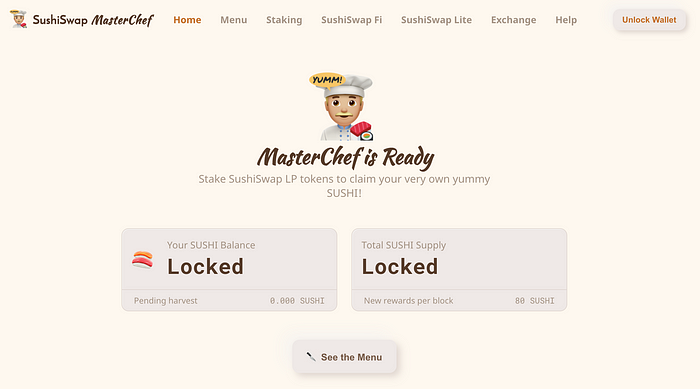

- Market Makers: Uniswap, Curve Finance, Sushiswap, Compound

Fintech Asset Classes

- Stocks, bonds, options, futures

Defi Asset Classes

- Synthetic assets: Synthetic, PieDAO, UMA, Yam

- Stable assets: USDC, USDT, ARCx, xDai

- Derivatives: Erasure, Opium Network, Derivadex

- Prediction markets: Augur, Flux, Polymarket, Veil

Banking ($9T)

Fintech

- Consumer: Monzo, Chime, Revolut, Nubank, N26

- Corporate: Brex, Mercury, Ramp

Defi

- This is an area where it is still unclear which key players in defi have emerged, though there are a few CeFi players like Kraken.

Real Estate ($9T)

Fintech

- Blend, Figure Technologies, Qualia, Cadre

Defi

- Similar to banking, slightly less presence of real estate investing in defi (so far), though we’ve seen a few crypto projects like Slice and Figure.

Lending ($7T)

Within the defi money markets, lending is at the center of all the activity. Unlike fintech, lending on defi requires little to no credit scoring or KYC flows. Without these controls, anyone can participate. Risks are offset by overcollateralization, but we will find out whether this system will enable more loans in the “mainstream” sense of the word.

Fintech

- Marketplace lending: SoFi, Lufax

- Direct lending & underwriting: Affirm, Credit Karma, Earnest

- Business lending: BlueVine

Defi

- Compound, Aave, Maker, Alpha Homora, RenVM

Insurance ($5T)

Similar to loans, insurance in defi targets the investment use case.

Fintech

- Healthcare, dental, “full stack”: Oscar, Clover, Zenefits, Clearcover, Gusto

- Home: Hippo, Lemonade

- Car: Metromile

- Life: Ethos

Defi

- Opyn, Nexus Mutual

Payments & Money Transfer ($3T)

Effective use case for defi, but relatively untapped for sending and receiving money. The defi twist could allow funds in the wallet also earn interest from the money markets.

Fintech

- Online payments processing: Stripe, Bolt, Airwallex, Adyen, Flywire, Razorpay

- POS: Square, Toast

- Personal payments & wallets: Alipay, Transferwise, Grab, Remitly, Paga, Zelle

Defi

- Online payments/POS: Flexa, Connext

- Personal payments: Sablier

Accounting ($106B)

This is mostly for business use cases. This is likely very far out for defi, and TBD if the use case makes sense.

Fintech

- Pilot, divvy

Defi

- Most accounting in defi today exists in portfolio tracking, which also includes guidance on taxes.

Compliance & Risk Management ($17B)

Fintech

- KYC, AML, credit scoring: Cognito, Onfido, Nova Credit

- Risk: Ayasdi, Robust Intelligence, Sift Science

Defi

- Risk management in defi still seems to sit in insurance, such as protection against smart contract failure (Nexus Mutual) or hedging your positions (Hegic, Opyn)

Data Aggregation ($16B)

The Plaid “connector” use case reminds me of aggregators in defi, though they are not exactly the same. An aggregator like Yearn doesn’t need a one-stop-shop like Plaid to connect to other protocols. However, it isn’t hard to imagine tools that expedite the connection from one app to various protocols.

Another relevant data use case is oracles for smart contracts, which don’t exist in traditional/fintech.

Fintech

- Plaid, Yodlee

Defi

- Oracles: Chainlink, API3, Razor Network, Dune Analytics

Financial Infrastructure APIs

These are the companies and projects that provide the rails in a “one stop shop” approach. Not too many in Defi, likely because each protocol offers its SDK or API.

Fintech

- Banking infrastructure API: Starling bank, Treasury Prime, Alloy, Railsbank

- Bank Connector API: Plaid

- Card issuing API: Marqeta, Stripe

Defi

- Infrastructure: The Graph, Covalent

Conclusion

It’s exciting to see the infrastructure, incentives and traction behind defi — especially in its capital markets.

The core of defi today feels like an alternative, gamified capital market (it even looks like a game — just look at the Sushiswap UI) where people are reaping high rewards and trying different strategies. High risk, high yield, high adrenaline.

One clear outcome of this study is just how much of financial services remains untapped by defi. For example, lending and insurance use cases beyond trading, payments, and investments in real estate or other creative assets.

As Chris Dixon said, what some “hackers” are doing with their weekends can become what everyone else will do during the week in 10 years.

Though for many hackers, defi has already gone from their weekend obsession to their day jobs.